The No-Nonsense Nigerian Guide

If your books are messy, your money will be too. Simple. Great products and hustle won’t save a business that can’t show where money comes from, where it goes, and what’s left. Clean books are how you get controlled growth, bank funding, and investor confidence, not vibes.

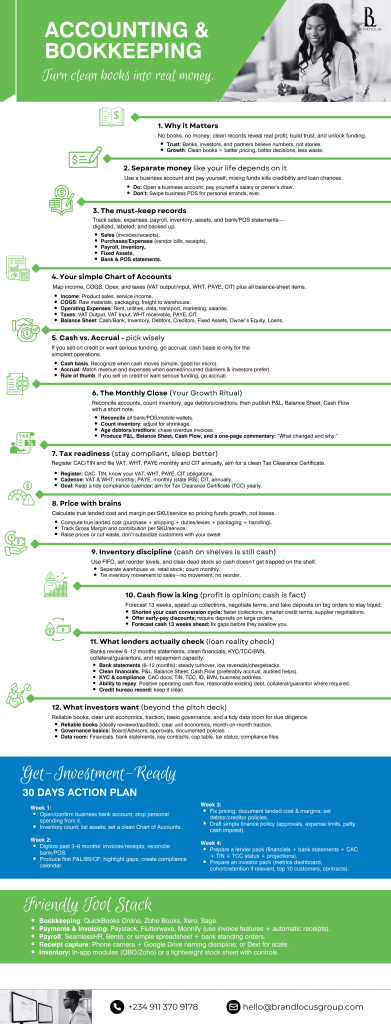

1) Start with “Why”: No Books, No Money

Accounting isn’t a checkbox; it’s your instrument panel. With it, you spot leaks, price properly, and negotiate from strength. Without it, you’re flying blind, until a bank, investor, or the taxman asks for proof.

2) Separate Business and Personal, Forever

Open a business bank account and pay yourself a salary or owner’s draw. Stop using business POS for household spending. Mixing funds is the fastest way to kill credibility with lenders, and it makes tax time a nightmare.

3) What to Track (Non-Negotiables)

Keep orderly records for:

- Sales & receipts, purchases & expenses

- Payroll, inventory, fixed assets

- Bank/POS/mobile wallet statements

Scan or snap every document and name it clearly (e.g.,2025-08-10_Vendor_85000.pdf). Back it up to Drive/Dropbox.

4) Build a Nigeria-Ready Chart of Accounts

Group transactions under:

- Income (product/service sales)

- COGS (raw materials, packaging, freight to warehouse)

- Operating Expenses (rent, utilities, data, logistics, marketing, salaries)

- Taxes: VAT Output, VAT Input, WHT receivable, PAYE, CIT

- Balance Sheet: Cash/Bank, Debtors, Creditors, Inventory, Fixed Assets, Owner’s Equity, Loans

5) Cash vs. Accrual - Choose Like a Pro

- Cash basis: record when money moves (fine for micro operations).

- Accrual: record when earned/incurred (best for credit sales, grants, investors, and banks).

If you extend credit or want serious funding, go accrual.

6) The Monthly Close (Your Growth Ritual)

Every month, reconcile all accounts, count inventory, and age debtors/creditors. Produce three reports, P&L, Balance Sheet, Cash Flow, then add a one-page note that explains what changed and why. This turns numbers into decisions.

7) Tax Readiness = Peace of Mind

Register CAC and get your TIN. Know your obligations:

- VAT & WHT - monthly

- PAYE - monthly (state IRS)

- CIT - annually

Aim for a clean Tax Clearance Certificate (TCC) each year. A tidy compliance trail boosts loan approvals.

8) Price with Unit Economics, Not Hope

Calculate true landed cost (purchase + shipping + duties/levies + packaging + handling). Track gross margin and contribution per SKU/service. If a product can’t pay its own way, fix it or cut it.

9) Inventory Discipline = Cash Control

Cash on your shelf is still cash. Use FIFO, set reorder levels, flag dead stock, and separate warehouse vs. retail stock. Count monthly. If it doesn’t move, discount it or bundle it, don’t let it rot.

10) Cash Flow Beats Profit (In Real Life)

Profit is opinion; cash is fact. Shorten your cash conversion cycle: collect faster, negotiate smarter supplier terms, and take deposits on large orders. Keep a 13-week cash forecast and plug gaps before they hurt payroll.

11) What Banks Actually Look For

- 6–12 months of bank statements with healthy, consistent inflows (low reversals)

- Clean financials (preferably accrual; audited/reviewed helps)

- KYC & compliance: CAC docs, TIN, TCC, BVN, valid ID, business address

- Repayment capacity: positive operating cash flow, manageable existing debt

- Collateral/guarantor where required and a clean credit bureau profile

12) What Investors Want (Beyond Slides)

Reliable books, clear unit economics, visible traction, and basic governance (approvals, policies, cap table hygiene). Set up a simple data room: financials, bank statements, key contracts, customer metrics, tax status, compliance files.

+1) A 30-Day “Get-Investment-Ready” Sprint

- Week 1: Lock the business account; map your Chart of Accounts; count inventory and list assets.

- Week 2: Digitize last 3–6 months of documents; reconcile everything; publish your first P&L/BS/CF.

- Week 3: Fix pricing; set credit & payment policies; draft a basic finance policy (approvals, petty cash, spend limits).

- Week 4: Compile a Lender Pack (financials + bank statements + CAC + TIN + TCC status + 12-month projections) and an Investor Pack (metrics dashboard, top customers, contracts, simple governance note).

Tools That Play Nice in Nigeria

- Bookkeeping: QuickBooks Online, Zoho Books, Xero, Sage

- Payments & Invoicing: Paystack, Flutterwave, Monnify

- Payroll: SeamlessHR, Bento (or a disciplined spreadsheet + standing orders)

- Receipt Capture: Phone camera + Drive; Dext if you scale

- Inventory: Built-in modules (QBO/Zoho) or a tight stock sheet with controls

Red Flags That Kill Deals

- Using one account for everything (personal + business)

- Cash-only sales with no receipts

- Vague transfer narrations (“stuff”, “misc”)

- No VAT/WHT/PAYE trail; unpaid CIT; no TIN/TCC

- “We’re profitable” but no reconciled reports to prove it